Share

Summary of data on the Creative, Cultural, and Digital Industries (CCIs) in Bradford:

Data analysed by BOP consulting shows that in 2019, the percentage of people in the Bradford district who are employed in one of the sub-sectors of the CCIs (Creative, Cultural and Digital Industries) was 1.8%, which is lower than the national average of 7.3%. This percentage was also lower than in other cities such as Newcastle upon Tyne and Gateshead (5.3%), Dundee (4.2%), and Sheffield (3.4%). This suggests that the CCI sector in Bradford is relatively underdeveloped compared to other cities.

Bradford has a significant number of small businesses operating within its CCI sector. 93% of these businesses have 4 or fewer employees, which is higher than the national average of 90% for CCI businesses and also higher than comparable cities.

However, despite the presence of these small businesses, employment in Bradford’s CCI sector decreased by 29% between 2015 and 2019, from 6,145 to 4,335, while Sheffield saw a 31% increase in CCI sector employment. This suggests that Bradford’s CCI sector has not experienced the same level of growth as other cities.

According to research conducted by Bradford 2025, a significant portion of cultural and creative practitioners in the district remain uncaptured by official statistics. It is estimated that between 2,500 and 3,000 sole traders in the field operate without registering for VAT or PAYE, resulting in their absence from current ONS data. This estimate was reached in 2021 through a survey of 290 cultural and creative workers in Bradford, a review of data held by Bradford district and comparison with national Department for Culture, Media and Sport (DCMS) figures.

The largest subsectors by employment are IT, Software and Computer Services (40%), Music, Performing and Visual Arts (12%) Advertising and Marketing (11%), and Film, TV, Video, Radio and Photography (11%). This breakdown is largely similar to the national profile of the sector.

The Gross Value Added (GVA) of the creative industries in Bradford, which includes the direct, indirect, and induced effects, exceeded £1bn in 2018, as shown in the table below. The analysis highlights the significance of IT, Software, and Computer Services to the sector.

Despite this, the GVA for the sector remains lower than that of comparable areas, partly due to a weaker technology sector. IT, Software, and Computer Services make up 39% of the sector’s GVA, which is lower compared to other areas such as Dundee (42%), Sheffield (48%) and the Newcastle & Gateshead area (62%).

| Subsector | Bradford (2018, £m) | Sheffield (2018, £m) | Newcastle & Gateshead (2018, £m) | Dundee (2018, £m) |

| All creative industries | 1,011 | 1,672 | 1,960 | 412 |

| IT, Software and Computer Services | 392 (39%) | 803 (48%) | 1206 (62%) | 171 (42%) |

| Rest of the creative industries | 619 (61%) | 869 (52%) | 753 (38%) | 241 (58%) |

The creative industries in Bradford are based in a range of locations across the district. Many businesses and organisations in the sector are located in the city centre, near major transport hubs and cultural institutions. There are clusters of creative industries businesses in some of the district’s more industrial areas, where they can benefit from access to shared facilities and resources.

Some of the key locations for the creative industries in Bradford include:

The creative industries in Bradford are based in a range of locations across the city district, with a particular focus on the city centre and industrial areas. According to BOP’s analysis, Bradford has no sub-sectoral strengths or clusters, and examining location quotient analysis51 suggests that Bradford district does not show particular strengths in any of the DCMS CIs subsectors.

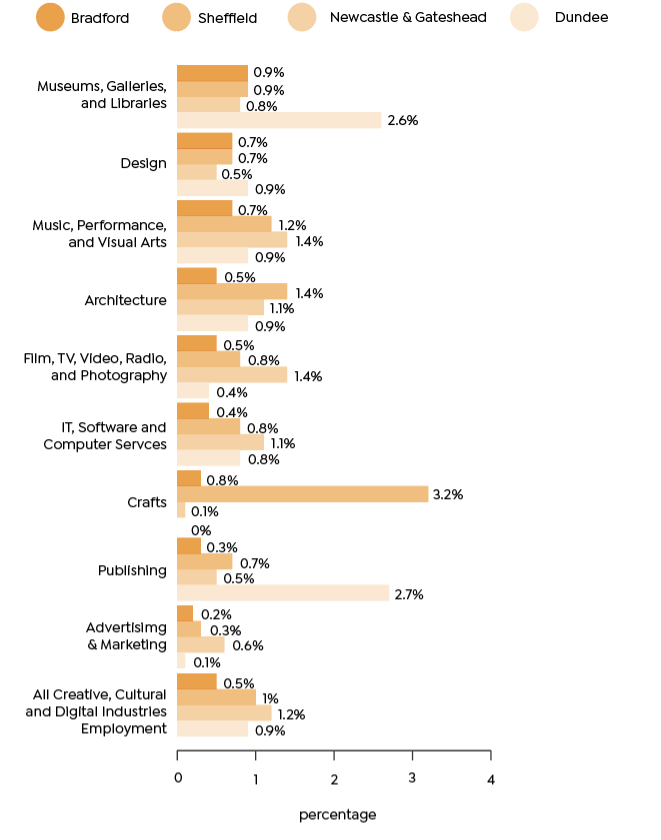

In contrast, all comparator cities have clusters within them, such as Sheffield which has significant cluster in crafts, but also in Architecture and Music, Performing and Visual Arts. Clusters help to increase the productivity of the businesses within them as, for instance, businesses can more easily exchange knowledge and skills. They therefore support business growth, attraction, and retention.

Source: BOP Consulting; ONS Business Register and Employment Survey Any number above 1 indicate a sub-sector with an employment concentration above average.

Contact us

Bradford Producing Hub

Assembly Bradford

20 North Parade

Bradford

BD1 3HT

Copyright © 2025 Bradford Producing Hub

Website designed and built by Out of Place Studio